Balancing debt finance and equity finance is a strategic decision for businesses , Navigating the Financial Landscape: Understanding Debt Finance and Equity Finance?

Introduction:

In the dynamic world of finance, businesses often seek capital to fund their operations, expansion, or new ventures. Two primary avenues for raising capital are debt finance and equity finance. Each comes with its own set of advantages and considerations, playing crucial roles in shaping the financial structure of a company. In this blog post, we will delve into the realms of debt and equity finance, exploring their definitions, characteristics, and the implications they carry for businesses.

Debt Finance:

Definition: Debt finance involves raising capital by borrowing money, typically through loans or bonds. In this arrangement, the borrower agrees to repay the principal amount along with interest over a specified period.

Characteristics:

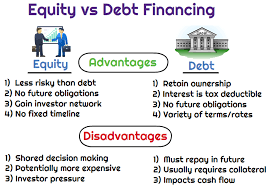

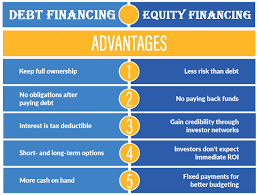

- Fixed Obligations: One of the defining features of debt finance is the fixed obligation to repay both the principal and interest, regardless of the company’s financial performance.

- Creditor Relationship: Businesses engaging in debt finance establish a creditor relationship with lenders. This means that the lenders have a legal claim on the company’s assets until the debt is fully repaid.

- Tax Deductibility: Interest payments on debt are often tax-deductible, providing a financial incentive for companies to utilize debt financing.

Considerations:

While debt finance provides a reliable source of capital, excessive debt can lead to financial strain, especially if the company faces economic downturns or challenges in meeting its repayment obligations.

Equity Finance:

Definition:

Equity finance involves raising capital by selling shares of ownership in the company. Investors who purchase these shares become partial owners and, in turn, share in the company’s profits and losses.

Characteristics:

- Ownership Stake: Equity investors acquire ownership stakes in the company, gaining voting rights and a share in any potential dividends.

- Risk and Reward Sharing: Unlike debt finance, equity finance distributes the risks and rewards of business operations among investors. If the company performs well, investors benefit; if it falters, they share in the losses.

- No Fixed Repayment Obligations: Unlike debt, equity financing does not impose fixed repayment obligations, offering more flexibility in financial management.

Considerations:

While equity finance provides flexibility and shared risk, it also involves diluting ownership and potentially relinquishing some control over the company.

Conclusion:

Balancing debt finance and equity finance is a strategic decision for businesses. Understanding the intricacies of each option empowers companies to make informed choices that align with their financial goals and risk tolerance. Whether opting for the stability of debt or the flexibility of equity, a well-thought-out financial strategy is key to navigating the complex terrain of corporate finance.