The coupled with a user-friendly GST calculator, equips individuals and businesses with the knowledge and tools necessary to navigate the intricate world of taxation in the fiscal year 2023-2024

Introduction:

As the financial year 2023-2024 unfolds, individuals and businesses in India find themselves at GST Calculator the intersection of evolving tax regulations. Navigating the intricacies of daily, weekly, fortnightly, and monthly tax obligations has never been more critical. This blog post aims to serve as a comprehensive guide, offering insights into the nuances of each tax category and introducing a user-friendly GST calculator to streamline calculations associated with the Goods and Services Tax.

Daily Tax Table:

For GST Calculator those with dynamic income streams or irregular work schedules, understanding daily tax liabilities is paramount. The daily tax table serves as a valuable tool in managing day-to-day tax obligations. By breaking down the daily tax calculations, this guide provides practical insights into how individuals can stay abreast of their tax responsibilities on a daily basis. From freelancers to gig workers, having a clear understanding of daily tax implications is essential for financial planning.

Weekly Tax Table:

Businesses and individuals operating on a weekly cycle need to grasp GST Calculator the corresponding tax implications. The weekly tax table becomes an indispensable resource for accurate tax planning in such scenarios. This section of the guide will delve into the intricacies of weekly tax calculations, offering tips on managing finances efficiently within a weekly timeframe. Understanding how weekly income affects tax liabilities empowers individuals to plan and allocate resources wisely.

Fortnightly Tax Table:

As GST Calculator some employees receive their salaries on a fortnightly basis, comprehending the associated tax implications is crucial. This guide will demystify fortnightly tax calculations, providing clarity on how income earned bi-weekly affects tax obligations. By breaking down the complexities, individuals can ensure that they are meeting their tax responsibilities accurately and efficiently.

Monthly Tax Table:

The monthly tax table is a go-to GST Calculator reference point for many individuals and businesses. Understanding the nuances of monthly tax calculations is vital for effective budgeting and financial management. This section of the guide will explore the intricacies of monthly tax obligations, offering insights into how individuals and businesses can plan their finances strategically on a monthly basis.

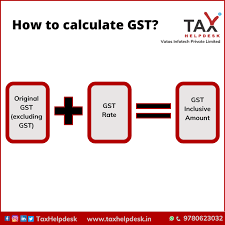

GST Calculator:

The Goods and Services GST Calculator is a significant component of India’s taxation system. However, calculating GST obligations can be a challenging task. To simplify this process, we introduce a user-friendly GST calculator. Whether you’re a business owner navigating input and output taxes or an individual trying to understand the GST implications on your purchases, this tool will prove invaluable in ensuring accurate and efficient calculations.

Conclusion:

Staying informed about the GST Calculator ever-evolving landscape of Indian taxation is crucial for financial success. This comprehensive guide to daily, weekly, fortnightly, and monthly tax tables, coupled with a user-friendly GST calculator, equips individuals and businesses with the knowledge and tools necessary to navigate the intricate world of taxation in the fiscal year 2023-2024. By staying informed and proactive in managing tax responsibilities, one can take control of their financial future and promote fiscal well-being.