Unleashing Financial Wisdom: A Comprehensive Exploration of “Rich Dad Poor Dad”

In the vast landscape of personal finance literature, “Rich Dad Poor Dad” by Robert Kiyosaki emerges as a timeless beacon of financial wisdom, challenging preconceived notions and inspiring a generation to rethink their approach to wealth. Let’s delve deeper into the transformative lessons woven into the fabric of this influential book.

1. The Dichotomy of Mindsets:

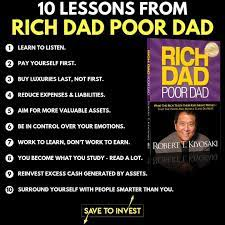

At its essence, “Rich Dad Poor Dad” is a tale of two contrasting philosophies embodied by the ‘poor dad’ and the ‘rich dad.’ The ‘poor dad,’ rooted in traditional values, advocates job security, a stable income, and the importance of formal education. In contrast, the ‘rich dad’ champions an entrepreneurial spirit, emphasizing financial education, investing, and asset-building as the keys to financial freedom.

2. The Imperative of Financial Education:

Kiyosaki passionately argues that formal education often neglects financial literacy, leaving individuals ill-equipped to navigate the complexities of real-world finance. The book serves as a rallying call for continuous self-education, urging readers to actively seek knowledge in areas such as investing, real estate, and entrepreneurship. According to Kiyosaki, true financial success begins with a commitment to ongoing learning.

3. Assets and Liabilities as Wealth Indicators:

A cornerstone of Kiyosaki’s teachings is the concept of assets and liabilities. He advocates for the acquisition of income-generating assets like real estate, stocks, and businesses, while minimizing liabilities such as debts and unnecessary expenses. This strategic approach to wealth creation is presented as a fundamental departure from the conventional wisdom of simply working for a paycheck.

4. Embracing Risk and Learning from Failure:

“Rich Dad Poor Dad” challenges the conventional fear of failure, asserting that mistakes are not setbacks but stepping stones to success. Kiyosaki encourages readers to take calculated risks and learn from failures, fostering resilience and adaptability. This mindset shift is crucial in an ever-changing financial landscape where the ability to navigate uncertainty is a key determinant of success.

5. Making Money Work for You:

A central theme of the book is the shift from working for money to making money work for you. Kiyosaki advocates for the creation of passive income streams through investments and entrepreneurship. By breaking free from the limitations of a traditional job-centric approach, individuals can achieve financial independence and create a life where their money is actively working to generate wealth.

6. The Entrepreneurial Mindset Unveiled:

“Rich Dad Poor Dad” celebrates the entrepreneurial spirit as a potent force for financial independence. Kiyosaki contends that cultivating an entrepreneurial mindset opens doors to creativity, innovation, and alternative avenues for income generation. Entrepreneurship, in his view, is not just about starting a business but embracing a mindset that seeks opportunities and values financial freedom.

personal finance literature

:In the grand tapestry of personal finance literature, “Rich Dad Poor Dad” stands as a masterpiece, resonating with readers across the globe. Its enduring appeal lies not only in the practical financial advice it imparts but in the fundamental mindset shift it instills. As you embark on your journey towards financial mastery, let “Rich Dad Poor Dad” be your guide, encouraging you to question norms, embrace financial education, and embark on a path towards lasting prosperity.

In the realm of personal finance literature, one book has stood the test of time, offering a fresh perspective on wealth-building and financial success. “Rich Dad Poor Dad” by Robert Kiyosaki is not just a book; it’s a roadmap to financial enlightenment, challenging traditional notions and guiding readers toward a mindset shift that can reshape their financial destinies.

1. The Tale of Two Dads:

At the heart of Kiyosaki’s narrative are the two influential figures who shaped his understanding of money – the ‘poor dad’ and the ‘rich dad.’ The juxtaposition of their philosophies serves as a compelling backdrop for the entire book. The ‘poor dad’ represents the traditional mindset of job security and a steady paycheck, while the ‘rich dad’ embodies a more entrepreneurial spirit, focusing on financial education, investing, and building assets.

2. The Power of Financial Education:

Kiyosaki argues that our formal education system often falls short in equipping individuals with the necessary financial knowledge to thrive in the real world. He emphasizes the need for continuous self-education, particularly in areas such as investing, real estate, and entrepreneurship. According to Kiyosaki, true wealth is built on a foundation of financial literacy.

3. Assets vs. Liabilities:

One of the book’s pivotal concepts is the distinction between assets and liabilities. Kiyosaki encourages readers to prioritize acquiring income-generating assets such as real estate, stocks, and businesses, while minimizing liabilities like debts and unnecessary expenses. This strategic approach to wealth creation forms the core of his unconventional financial philosophy.

4. Embracing Risk and Learning from Failure:

“Rich Dad Poor Dad” challenges the fear of failure, advocating for a mindset that views mistakes as opportunities for growth. Kiyosaki believes that taking calculated risks and learning from failures are integral to achieving financial success. This perspective fosters resilience and a willingness to step outside one’s comfort zone in the pursuit of wealth.

5. Making Money Work for You:

A key takeaway from the book is the shift from working for money to making money work for you. Kiyosaki encourages readers to explore avenues of passive income, such as investments and entrepreneurship, as a means to break free from the limitations of a traditional job-centric approach to earning.

6. The Entrepreneurial Mindset:

“Rich Dad Poor Dad” celebrates the entrepreneurial spirit as a pathway to financial independence. It inspires readers to think beyond the confines of a 9-to-5 job and consider alternative avenues for income generation. Entrepreneurship, in Kiyosaki’s view, is a powerful tool for creating wealth and achieving lasting financial success.

Conclusion:

In conclusion, “Rich Dad Poor Dad” is not just a book; it’s a manifesto for financial empowerment. Its enduring popularity stems from its ability to transcend generational and cultural boundaries, resonating with readers seeking a roadmap to financial prosperity. As you embark on your financial journey, let the lessons from “Rich Dad Poor Dad” serve as a compass, guiding you toward a future of informed financial decisions, continuous learning, and wealth creation.